Aldea Vertical, Madrid

Main objectives of the project

In the midst of Madrid's housing crisis, characterized by soaring property prices and a shortage of affordable options, resilient social housing initiatives, such as the project spearheaded by the Madrid City Council through the EMVS, are challenging the pressures of gentrification. This vertical village of 85 social housing units represents a beacon of hope, offering dignified contemporary housing at regulated prices. Comprising a mix of ownership and rental units, the project accommodates diverse family structures and promotes social and family diversity through temporary rotations. Embodying innovative design elements, such as geometric setbacks and ceramic lattice systems, the project fosters community cohesion while providing residents with spaces for interaction and engagement, reminiscent of traditional village life, within the urban landscape.

Date

- 2020: Construction

Stakeholders

- Promotor: Empresa Municipal de la Vivienda y Suelo.

- Architect: llps arquitectos

Location

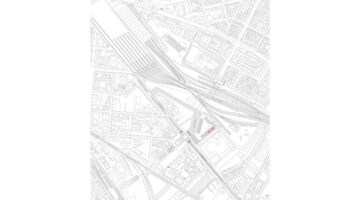

City: Madrid

Country/Region: Madrid, Spain

Description

Madrid is currently grappling with a severe housing crisis, marked by skyrocketing property prices and a significant shortage of affordable housing options. This crisis exerts immense pressure on the city's most vulnerable populations, leading to widespread gentrification that displaces long-standing residents in favor of high-income newcomers. In response to these challenges, resilient social housing projects are emerging, aimed at countering the adverse effects of the free-market housing boom and ensuring that even the most disadvantaged individuals have access to dignified, contemporary housing.

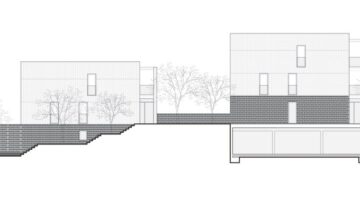

In an urban landscape where gentrification often displaces the most disadvantaged, a resilient social housing project promoted by the Madrid City Council through the EMVS stands firm against the pressures of free-market housing growth. This initiative offers dignified contemporary housing for the most needy at regulated, affordable prices, despite the complexity of constructing a 17-floor vertical tower.

At the intersection of pedestrian public space and railway infrastructure, a vertical village of 85 social housing units rises from a textured concrete base. This tower complements the EMVS's social housing blocks, featuring a mix of ownership and rental units to support a diverse range of family structures, including numerous, multi-nuclear, single-parent, and single-person households, facilitating temporary rotations and enhancing social and family diversity.

The imposing white volume, adhering to geometric setback regulations on the upper floors, faces north with a smooth surface punctuated by a systematic array of square openings corresponding to bedroom scales. This design conceptually ties Horizon-Ground and Horizon-Sky, breaking down the urban scale of neighboring buildings and providing an enriching spatial reference through its abstract form.

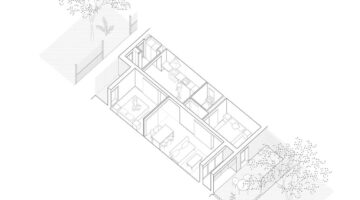

In contrast, the southern elevation features a complex arrangement of setbacks and depths with ceramic lattice systems, offering protection from summer sun and heat while allowing light in during winter. This depth system incorporates diagonal spaces traversing the entire block, enabling residents to engage with their surroundings at various scales—territorial through horizontal views, urban through transverse visions, and communal through integrated terraces.

The project revives the idea of a primordial neighborhood, fostering a sense of community through interconnected spaces that facilitate neighborly interactions in all directions: diagonal, vertical, and horizontal. This concept of vertical streets within the urban alignment plane encourages encounters and relationships among residents, reminiscent of the German Siedlungen or Viennese Höfe, but with an enhanced focus on interrelation. Outdoor terrace spaces serve as communal meeting points, allowing residents to engage with their neighbors, akin to villagers sitting at their doorsteps, thus promoting crucial social interaction, especially significant during times of confinement.