DC Flex, Washington DC

Main objectives of the project

The housing crisis in the US, particularly affecting Washington DC, prompted the introduction of the DC Flexible Rent Subsidy Program (DC Flex) in 2017, aiming to assist middle-class individuals and low-income families facing delays in traditional housing assistance. Unlike existing programs like housing choice vouchers (HCVs) and rapid rehousing (RRH), DC Flex offers fixed subsidies to extremely low-income households, providing flexibility in rent payments and serving as a financial safety net for those living paycheck to paycheck. A study conducted after its first year of implementation revealed positive outcomes, with the program effectively maintaining housing stability and reducing homelessness rates among participants to just 1.8%. This measure do not only offer good results, but it is a good practice of governance with NGOs and of simplification of administrative burden.

Date

- 2017: Implementation

Stakeholders

- District of Columbia Council

Location

Country/Region: United States of America, Washington D.C.

Description

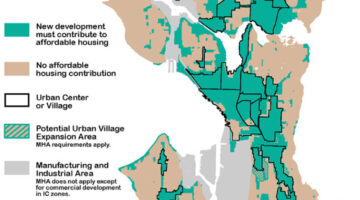

The housing crisis gripping the United States has put immense pressure on Washington DC's housing market. Despite traditional and federal subsidies, the District of Columbia found itself grappling with a complex situation, particularly in aiding middle-class individuals. While many low-income families qualify for housing choice vouchers (HCVs), the lengthy waiting lists often delay assistance. Rapid rehousing (RRH) programs offer short-term rental subsidies, but their long-term effectiveness is uncertain. To bridge this gap, the DC Flexible Rent Subsidy Program (DC Flex) was introduced in 2017 as a four-year pilot initiative, funded by a $5 million appropriation from the District of Columbia Council and supported by Mayor Muriel Bowser.

DC Flex targets extremely low-income households, comprising those earning up to 30 percent of the area median income, with at least one employed adult and children. Participants must have recently sought emergency or temporary housing assistance and reside in a legal rental unit within the city. The program aims to prevent eviction for families living paycheck to paycheck. Each household enrolled in DC Flex receives a checking account and an escrow account containing the full $7,200 subsidy balance. This subsidy can only be used for rent payments, with participants granted flexibility in allocating funds. In other words, each month they can choose how much money of the fund they use to pay the rent. Capital Area Asset Builders, a District-based financial education nonprofit, manages the program, transferring funds from the escrow account to the checking account monthly to cover rent expenses. Unlike HCVs, DC Flex subsidies remain fixed regardless of changes in income or household size, serving as a financial safety net for low-income families facing income disruptions.

A study conducted after the first year of implementation found that DC Flex was successfully launched and managed. The Urban Institute, responsible for the assessment, recommends DC Flex as a viable alternative to existing housing services based on initial findings. Focus groups highlighted the program's role in maintaining housing stability, particularly for families ineligible for other subsidy programs or exiting RRH. Over time, program adjustments have extended the eligibility period to five years and increased the subsidy amount to over $8,000. However, once participants' earnings exceed 40% of the Area Median Income, their benefits cease. Notably, upon program completion, families gain unconditional access to any remaining funds in their account, effectively transforming it into a Basic Income. With only 1.8% of participants experiencing homelessness after exiting the program, DC Flex demonstrates promising outcomes compared to control groups.